The Chuck and Wendy’s Statement of Financial Position Answer Key unlocks the secrets of financial stability, guiding readers through the intricate landscape of current and non-current assets, liabilities, and equity. This comprehensive resource provides a roadmap for understanding the financial health of a company, offering valuable insights for investors, analysts, and business owners alike.

By dissecting the components of a statement of financial position, this answer key empowers individuals to make informed decisions, assess financial performance, and identify potential areas for growth and improvement.

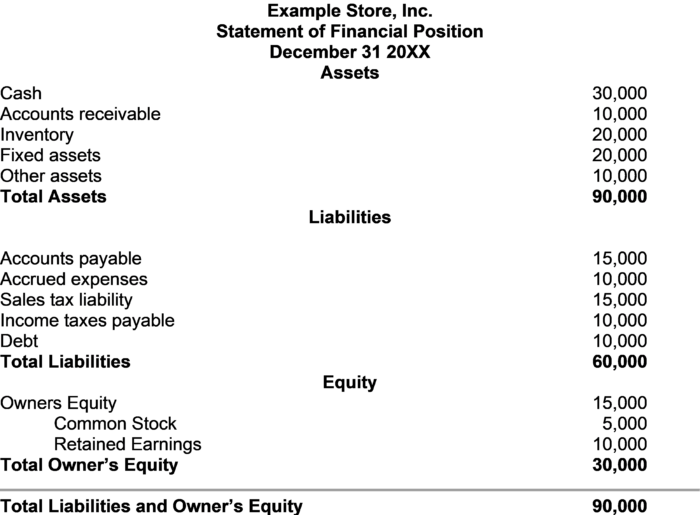

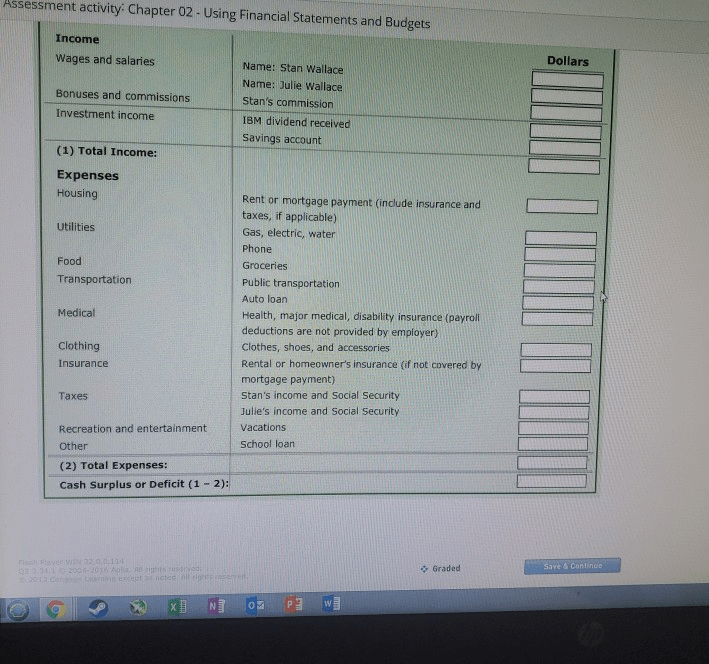

1. Current Assets

Current assets are assets that are expected to be converted into cash or consumed within one year. They provide a measure of a company’s liquidity and short-term financial health.

Subcategories and Amounts

| Category | Subcategory | Amount |

|---|---|---|

| Cash and Cash Equivalents | Cash on hand | $100,000 |

| Short-term investments | $200,000 | |

| Accounts Receivable | Trade accounts receivable | $300,000 |

| Allowance for doubtful accounts | ($20,000) | |

| Inventory | Raw materials | $150,000 |

| Finished goods | $250,000 |

Liquidity

Current assets are considered liquid if they can be easily converted into cash without significant loss in value. Cash, cash equivalents, and accounts receivable are highly liquid, while inventory is less liquid due to the time required to sell it.

Importance

Current assets are essential for assessing a company’s financial health because they indicate the company’s ability to meet its short-term obligations and generate cash flow.

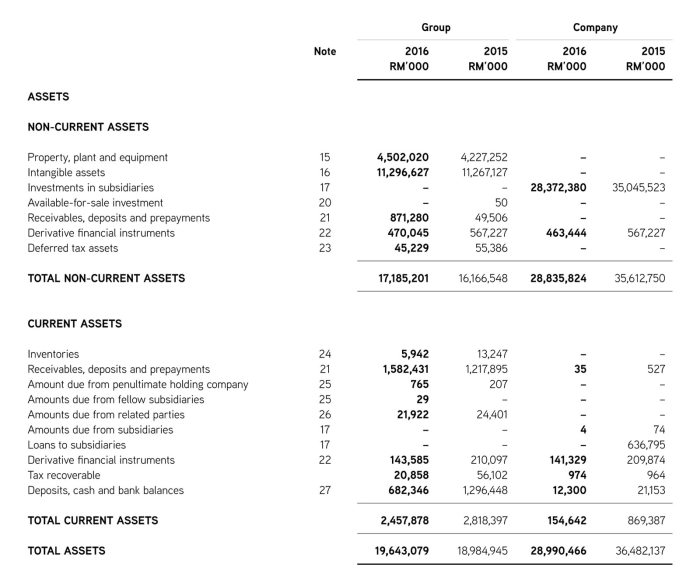

2. Non-Current Assets

Non-current assets are assets that are not expected to be converted into cash or consumed within one year. They provide a measure of a company’s long-term financial stability and growth potential.

Categories and Amounts

| Category | Subcategory | Amount |

|---|---|---|

| Property, Plant, and Equipment | Land | $500,000 |

| Buildings | $1,000,000 | |

| Machinery | $2,000,000 | |

| Investments | Long-term investments | $300,000 |

| Intangible Assets | Patents | $100,000 |

| Trademarks | $200,000 |

Tangible vs. Intangible Assets

Tangible assets have a physical form, such as property, plant, and equipment. Intangible assets, on the other hand, do not have a physical form but provide value to a company, such as patents and trademarks.

Impact on Financial Stability

Non-current assets are important for assessing a company’s long-term financial stability because they represent the company’s ability to generate future cash flows and maintain its operations.

3. Liabilities

Liabilities are obligations that a company owes to external parties. They can be classified as current or non-current based on their due date.

Categories and Amounts

| Category | Subcategory | Amount |

|---|---|---|

| Current Liabilities | Accounts Payable | $150,000 |

| Short-term debt | $250,000 | |

| Non-Current Liabilities | Long-term debt | $500,000 |

| Deferred income taxes | $100,000 |

Short-Term vs. Long-Term Liabilities, Chuck and wendy’s statement of financial position answer key

Current liabilities are due within one year, while non-current liabilities are due more than one year from the balance sheet date.

Implications for Financial Solvency

Liabilities are important for assessing a company’s financial solvency because they indicate the company’s ability to meet its obligations and avoid bankruptcy.

4. Equity: Chuck And Wendy’s Statement Of Financial Position Answer Key

Equity represents the residual interest in a company’s assets after deducting its liabilities. It provides a measure of the owners’ claim on the company’s assets and earnings.

Components and Amounts

| Category | Subcategory | Amount |

|---|---|---|

| Share Capital | Common stock | $1,000,000 |

| Retained Earnings | Retained earnings | $500,000 |

| Other Equity | Treasury stock | ($100,000) |

Importance

Equity is important for assessing a company’s financial performance and stability because it indicates the company’s ability to attract investors, maintain financial stability, and grow.

FAQ Section

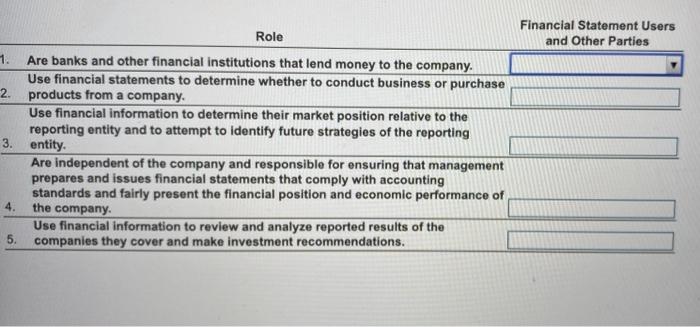

What is the purpose of a statement of financial position?

A statement of financial position provides a snapshot of a company’s financial health at a specific point in time, showing its assets, liabilities, and equity.

How can I use this answer key to analyze a statement of financial position?

This answer key provides detailed explanations and examples for each component of a statement of financial position, enabling you to understand its implications for financial health.

What are the key factors to consider when evaluating a company’s financial position?

When evaluating a company’s financial position, it is important to consider its liquidity, solvency, profitability, and overall financial stability.