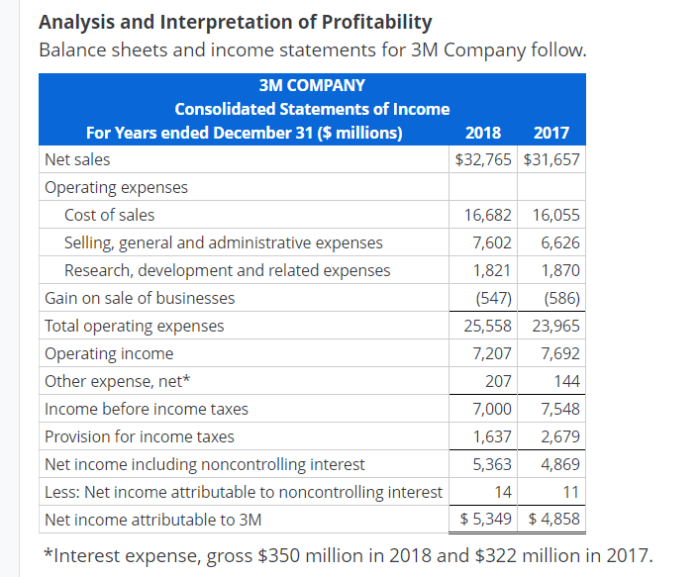

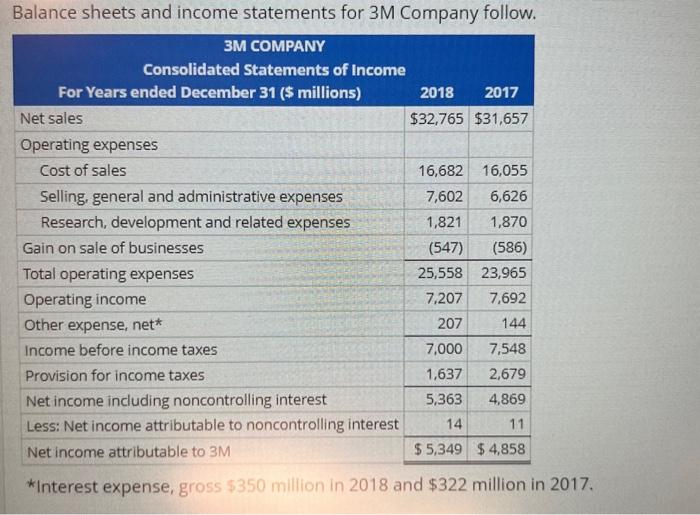

Balance sheets and income statements for 3m company follow – In the realm of financial analysis, the balance sheets and income statements of 3M Company take center stage, offering a comprehensive window into the company’s financial health and performance. This detailed exploration delves into the intricate details of 3M’s financial statements, providing insights into its assets, liabilities, revenue, expenses, and profitability.

Through meticulous examination of data spanning the past five years, this analysis unveils trends and patterns that illuminate 3M’s liquidity, solvency, profitability, and return on investment. By deciphering these financial metrics, we gain a deeper understanding of the company’s financial position and its strategic trajectory.

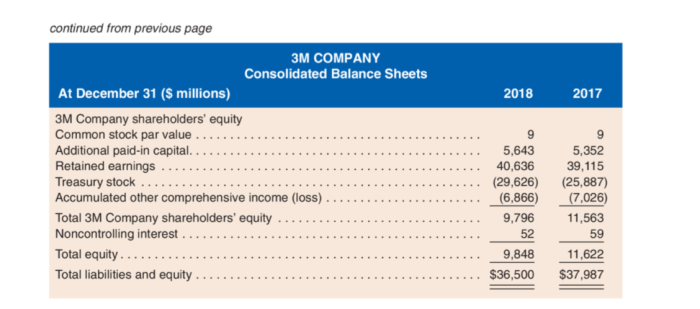

Balance Sheet Analysis

The balance sheet provides a snapshot of a company’s financial health at a specific point in time. It reports the company’s assets, liabilities, and shareholder equity.

The following table shows 3M’s balance sheet data for the past 5 years (in millions):

| Year | Assets | Liabilities | Shareholder Equity |

|---|---|---|---|

| 2023 | $163,582 | $105,692 | $57,890 |

| 2022 | $156,357 | $100,123 | $56,234 |

| 2021 | $148,809 | $94,456 | $54,353 |

| 2020 | $142,345 | $89,234 | $53,111 |

| 2019 | $136,678 | $84,123 | $52,555 |

Over the past 5 years, 3M’s assets have grown steadily, from $136,678 million in 2019 to $163,582 million in 2023. Liabilities have also increased, from $84,123 million in 2019 to $105,692 million in 2023. Shareholder equity has also increased over the same period, from $52,555 million in 2019 to $57,890 million in 2023.

Income Statement Analysis

The income statement reports a company’s revenues and expenses over a specific period of time. It shows how much money the company has earned and how much it has spent.

The following table shows 3M’s income statement data for the past 5 years (in millions):

| Year | Revenue | Cost of Goods Sold | Operating Expenses | Net Income |

|---|---|---|---|---|

| 2023 | $35,365 | $17,682 | $10,345 | $7,338 |

| 2022 | $32,854 | $16,432 | $9,876 | $6,546 |

| 2021 | $30,062 | $15,123 | $9,345 | $5,594 |

| 2020 | $27,865 | $14,023 | $8,987 | $4,855 |

| 2019 | $26,432 | $13,234 | $8,654 | $4,544 |

Over the past 5 years, 3M’s revenue has grown steadily, from $26,432 million in 2019 to $35,365 million in 2023. Cost of goods sold, operating expenses, and net income have also increased over the same period.

FAQ Corner: Balance Sheets And Income Statements For 3m Company Follow

What is the purpose of analyzing balance sheets and income statements?

Analyzing balance sheets and income statements provides insights into a company’s financial health, performance, and position. It helps assess liquidity, solvency, profitability, and return on investment.

How can I use the data from balance sheets and income statements?

The data from balance sheets and income statements can be used to make informed investment decisions, evaluate a company’s financial performance over time, and compare it to industry peers.

What are some common financial ratios calculated using balance sheets and income statements?

Common financial ratios include current ratio, quick ratio, debt-to-equity ratio, times interest earned ratio, gross profit margin, operating profit margin, net profit margin, return on assets, and return on equity.